Coople Payment.

It is important to us that your work is compensated fairly and punctually. Learn more about when you can expect to receive your salary and what it includes.

What is on my payslip?

The Coople payslips contain all the details about your wage, as well as all statutory deductions and supplements. It can be a bit complicated to understand exactly what is listed on your payslip. So, we’ll give you a quick overview here.

COOPLE PAYMENT

Let’s start with the basics:

Let’s now take a closer look at the payslip:

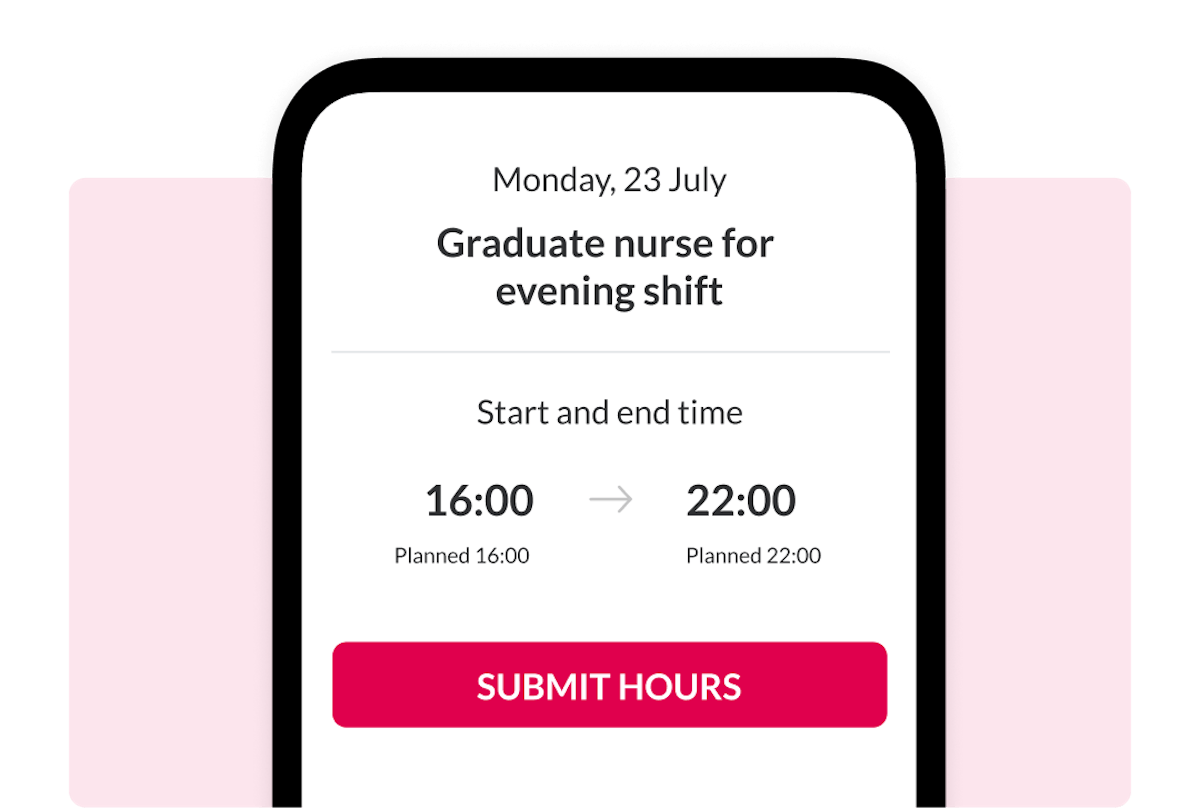

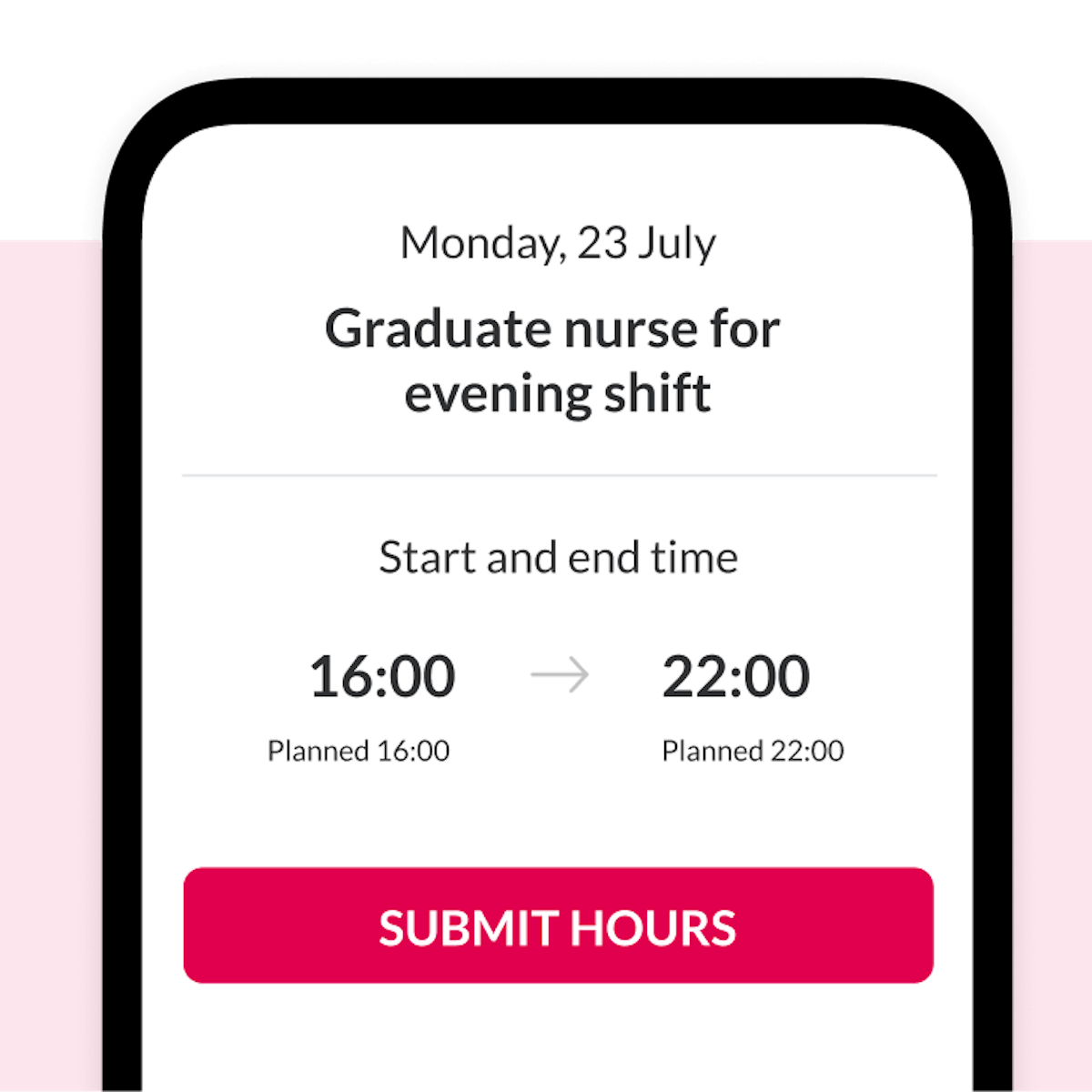

1. Gross wage: this amount is the wage total of all your jobs in the corresponding month. For each job, the number of working hours is multiplied by the hourly wage.

2. Total deductions: this amount represents the social security contributions – your old-age pension (AHV, BVG), accident and health insurance (NBU, KTG), and unemployment insurance (ALV) – which are deducted from your gross wage in accordance with the legal requirements.

3. Net wage: this amount is made up of the gross wage less (minus) the total of deductions.

4. Rounding: if your net wage has an impossible decimal place (e.g., 82 centimes), the amount is rounded up or down accordingly.

5. Payment amount: we will pay you this amount according to the payment details in your Coopler profile. It corresponds to your Coople monthly wage.

How do you get your pay on time?

It is important that you set up your profile correctly when you register so that we can pay you on time. To avoid late payments, you should put your bank details on your profile.

Need further help?

If you feel something is wrong on your pay slip, or you have any other questions, you can email info.ch@coople.com.

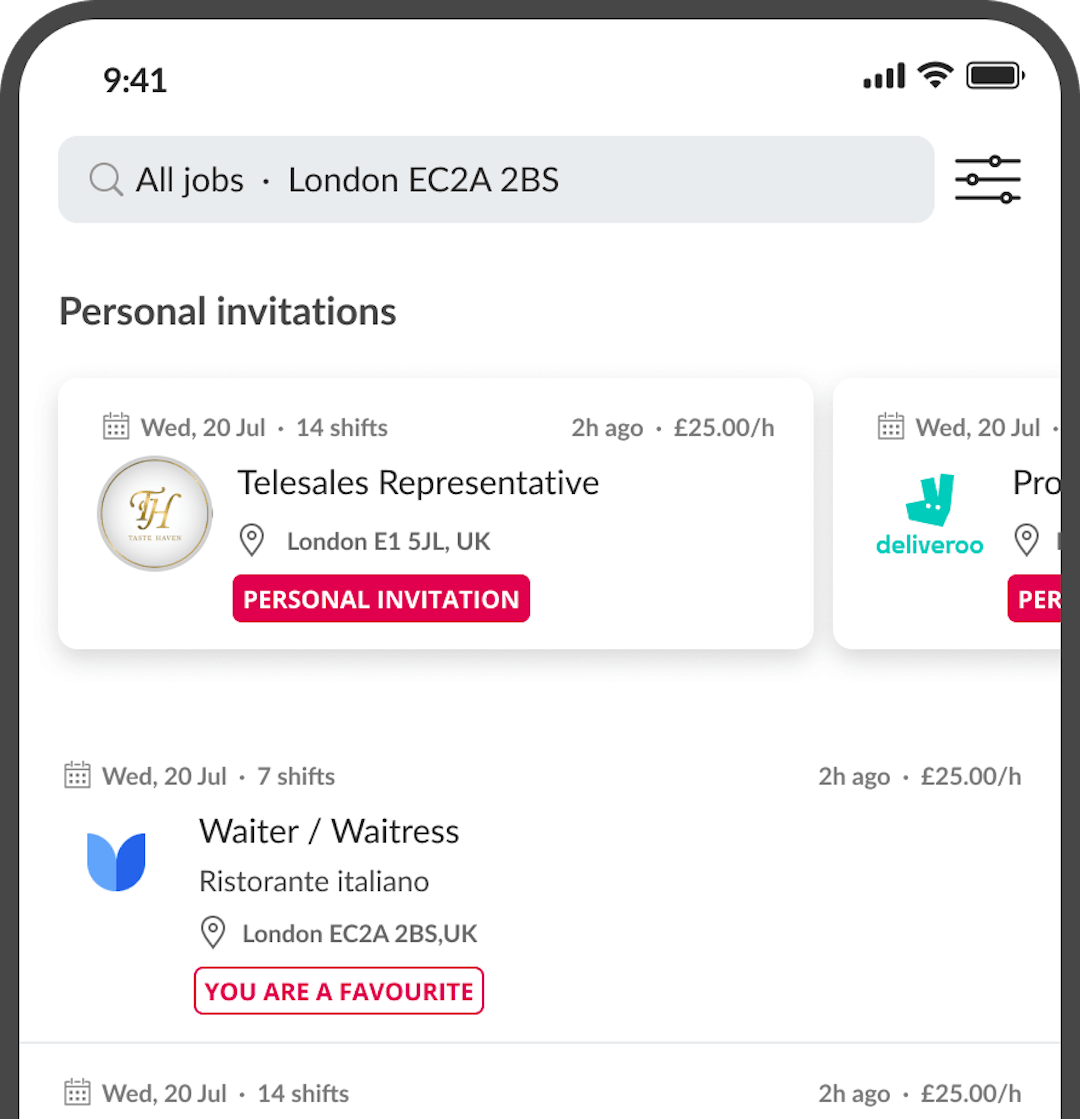

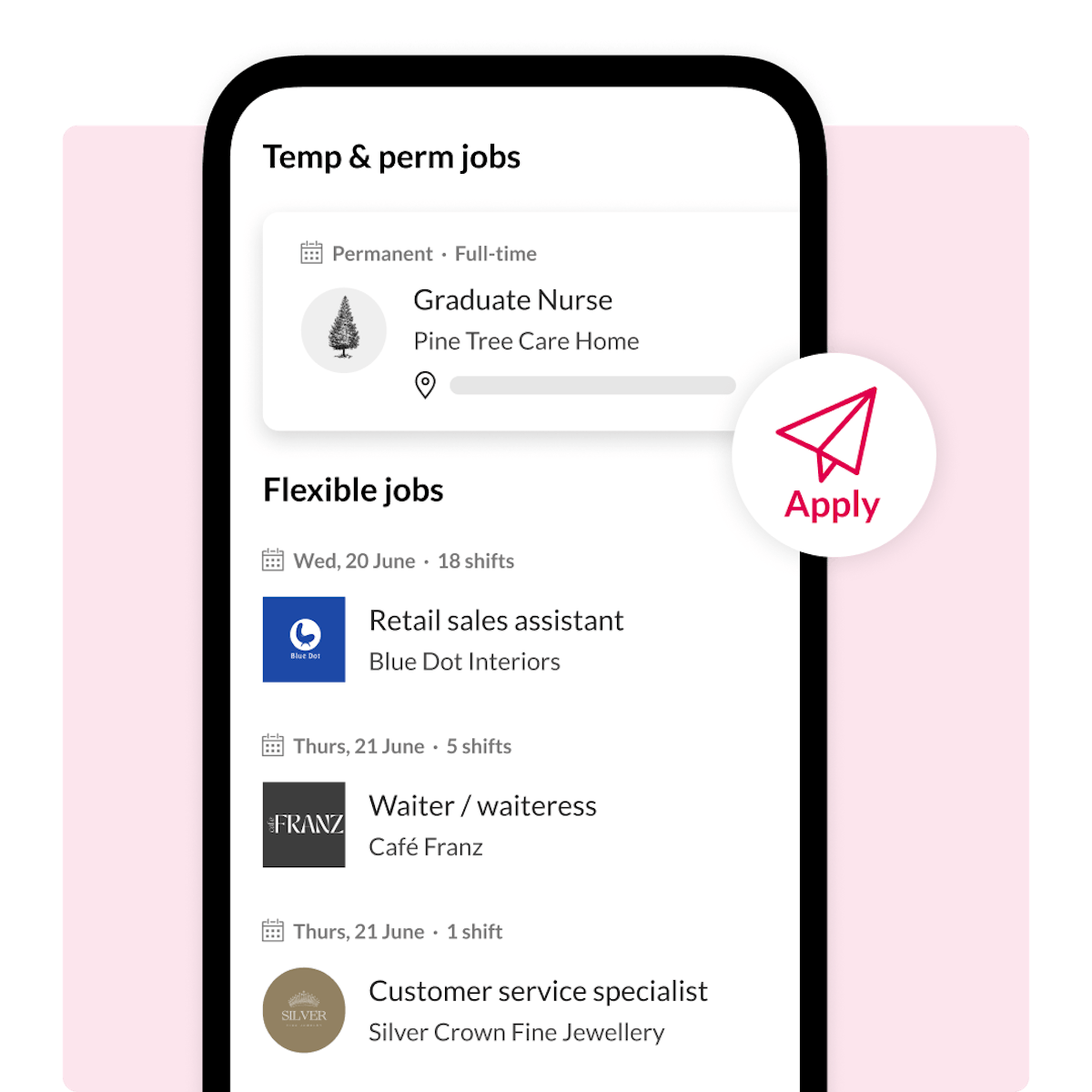

Find flexible jobs that work for you.

Download the Coople Jobs app and sign up today to gain access to flexible jobs.